02 Mar Private Credit: A Timely Introduction

By QP Wealth Management

March 2, 2021

Our experience with alternative investments has us well-acquainted with the edge they can offer a portfolio, a concept we introduced in our first blog. This past year created an interesting economic backdrop which beckons us to dial in to one sub asset class in particular, private credit.

2020 proved tough for income investors. The Fed’s commitment to zero-range short-term interest rates proved successful in buffering the economic effects of COVID-19 while also creating a crunch for yield. To top it off, taxes and the likelihood of inflation mean investors will need higher yields to achieve even a modest income stream. All said, a fitting time for an introduction to private credit.

After the events of 2008, regulators enacted stricter oversight over commercial banks with the implementation of Dodd-Frank Act and Basel III. Designed to protect consumers, these regulations also caused banks to pull back on loans to small, mid-sized or riskier borrowers. As a result, the private market stepped in and the asset class has seen incredible growth since.

Private credit is an asset class primarily of loans to non-investment grade middle market businesses, but they can vary greatly in makeup. Typically higher-yielding, illiquid investment opportunities, these funds run the gamut of risk/return profiles from secured senior debt with fixed income-like characteristics, to distressed debt with equity-like risk and returns.

Compared to banks, private credit provides benefits to borrowers, lenders, and investors. Borrowers gain access to more customized and flexible lending solutions with greater speed and ease of execution. Lenders can benefit from better protections through financial covenants on borrowers, access to secured, structurally senior, floating rate debt and historically higher yields versus traditional credit markets. Investors share in on lender benefits while also gaining diversification from publicly traded fixed income and illiquidity premiums.

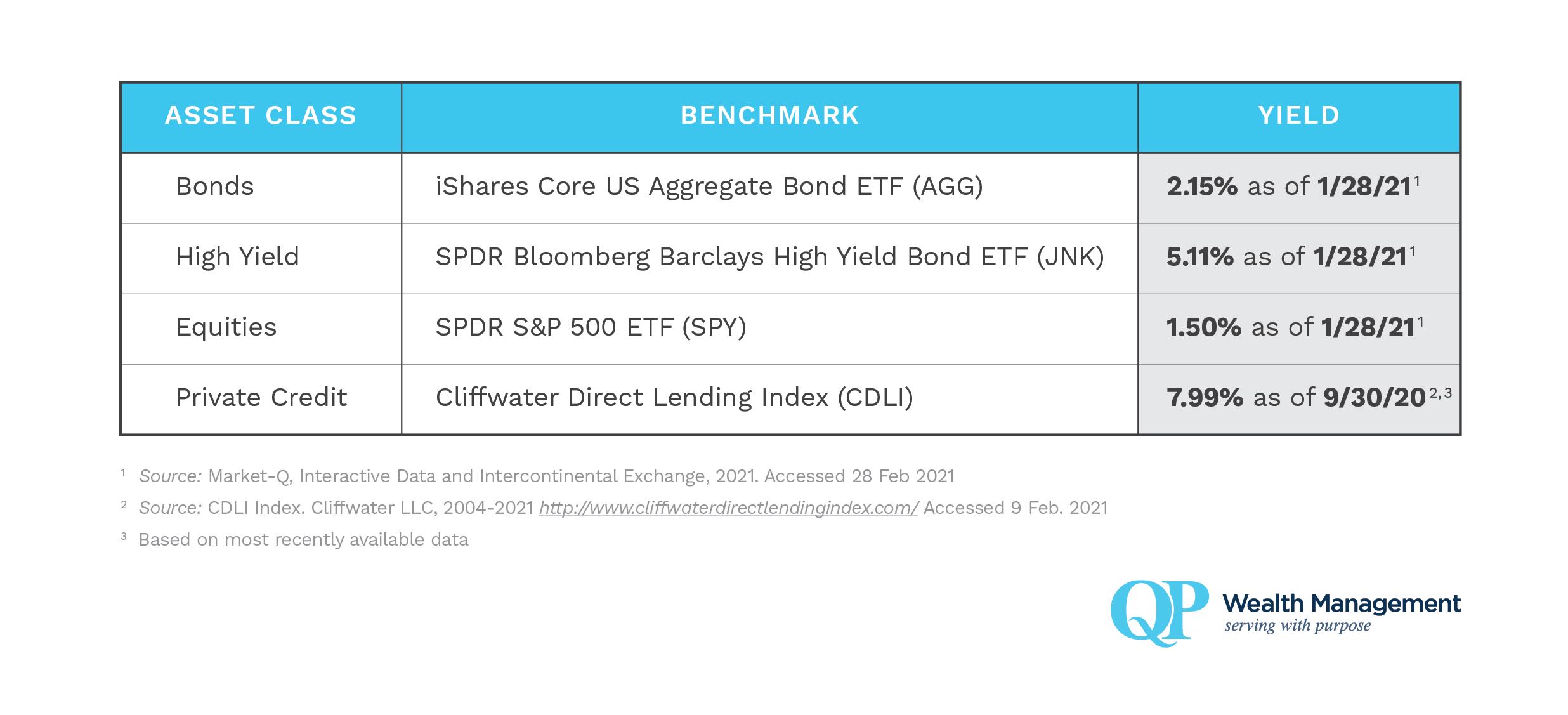

Relative to more traditional methods for capturing yield (i.e. Bonds, High Yield, Dividend Paying Stocks) private credit comes out swinging. In the below comparison of benchmarks, private credit (CDLI) yields more than high yield bonds (JNK) and more than triple traditional bonds (AGG). To top it off, the floating rate structure common to private credit typically makes them an inflation hedge – a trait traditional fixed income can lack. Timely, considering the CPI (a measure of inflation) rose 1.4% in 2020[1] and is expected to continue doing so.

A risk/reward comparison also paints a pretty picture for the asset class. Using Morgan Stanley’s 2020 GIC Capital Market Assumptions, we see that in comparison to the same asset classes private credit shows better-than-equity return projections with half the volatility over the next seven years. In fact, their seven-year estimates show private credit’s volatility falling between that of US Taxable Fixed Income and High Yield but with more than double the return expectation. It is extremely important that investors considering private credit are extremely diligent in their manager selection. These are not publicly available vehicles and access is often limited and, therefore, key. Funds with access to experienced management teams can benefit from expertise in pricing risk. The first step in evaluating a private credit fund is understanding these complicated and diverse strategies. We emphasize how important it is to have this in-depth knowledge and to complete proper due diligence. Illiquidity and high minimums also mean that participation is limited to those who are qualified and suitable for such risk.

Private credit is a diverse space. The asset class encompasses an array of investments ranging across the capital stack. While positioning on the risk/reward scale can differ from fund to fund, the consistent theme lies in the variety of opportunities for earning income. Employed within a portfolio’s overall alternative investment allocation, it can be a great solution for yield and diversification in an otherwise unappealing environment.

QP Wealth Management is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

QP Wealth Management may discuss and display, charts, graphs, formulas that are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

[1]source: Economic News Release, Bureau of Labor Statistics U.S. Department of Labor 1/11/21, https://www.bls.gov/news.release/cpi.nr0.htm, accessed 19 Feb 2021