14 Jun Private Real Estate: Opportunity Knocks Beyond the Housing Market

By QP Wealth Management

June 8, 2021

Residential real estate isn’t the only real estate investment worthy of hype this year. Much like private credit, private real estate is an alternative investment subset of particular relevance in today’s investing environment. Private real estate is defined as direct ownership of physical real estate with the intent to make a profit. More specifically, it is professionally managed, pooled, private, and public investments in the real estate market. While we are defining a broad asset class there are three main segments worth identifying:

Residential real estate isn’t the only real estate investment worthy of hype this year. Much like private credit, private real estate is an alternative investment subset of particular relevance in today’s investing environment. Private real estate is defined as direct ownership of physical real estate with the intent to make a profit. More specifically, it is professionally managed, pooled, private, and public investments in the real estate market. While we are defining a broad asset class there are three main segments worth identifying:

- Core: Think high-quality, high-value real estate assets with predictable cash flows and steady returns. These properties are usually in primary markets (see below) and fully leased. Core is generally less risk, lower return, generating immediate & stable cash flow to the investor.

- Value Added: These properties require some level of improvement and are purchased with the intent to sell at an increased value. A step up in the risk/reward scale from core and vary on the timeline for delivering income or returns.

- Opportunistic: Either the full development of a property from the ground up, or the improvement of a property in lagging or underdeveloped market. These require lengthier timelines for realization and a greater appetite for risk but carry the greatest opportunity for maximized returns. Investors can expect little to no income in early stages.

Asset managers can also incorporate a mix of core, value added, and opportunistic into one fund to balance the risk/reward of each segment and smooth out the j-curve effect associated with longer-dated projects. Core Plus, for instance, is a blend of strategies ranging from core to opportunistic.

These segments broadly define and categorize private real estate but the underlying real estate property carries its own level of risk, return expectation, and investment timeframe. Multifamily housing, office buildings, industrial parks, self-storage, hotels, and senior housing are examples from a deep pool of real estate offerings. The investments are further categorized by the market where they are domiciled. Primary markets are areas deemed as “essential”, high in demand and density, and generally less susceptible to market cycles. Secondary and tertiary environments being more remote and less developed, potentially adding risk. All of which should be considered when assessing the overall fund.

Why invest in private real estate? For starters, it’s a diversifier – as opposed to stocks, bonds, etc. your investment is in the underlying property(ies) which are uncorrelated to traditional asset classes, reducing exposure to broad market movements. And because these assets are based on the values of physical property their values don’t fluctuate very much over the short term, offering lower volatility than stocks AND bonds. [1]

Private real estate is an inflation hedge; a point we considered leading with given everyone’s laser sharp focus on the CPI. As inflation rises managers can raise rents to offset the effect. They can raise rents; it’s important to know what you’re investing in. Particularly, an opportunistic investment may be more susceptible to the effects of interim inflation.

It is a great tool for achieving tax efficiency. As the underlying property depreciates in value the depreciation allowance can be deducted from the income earned. The sale of property is also taxed at the capital gains rate rather than ordinary income rate. For those sitting at the highest income tax rates, this can be a major selling point.

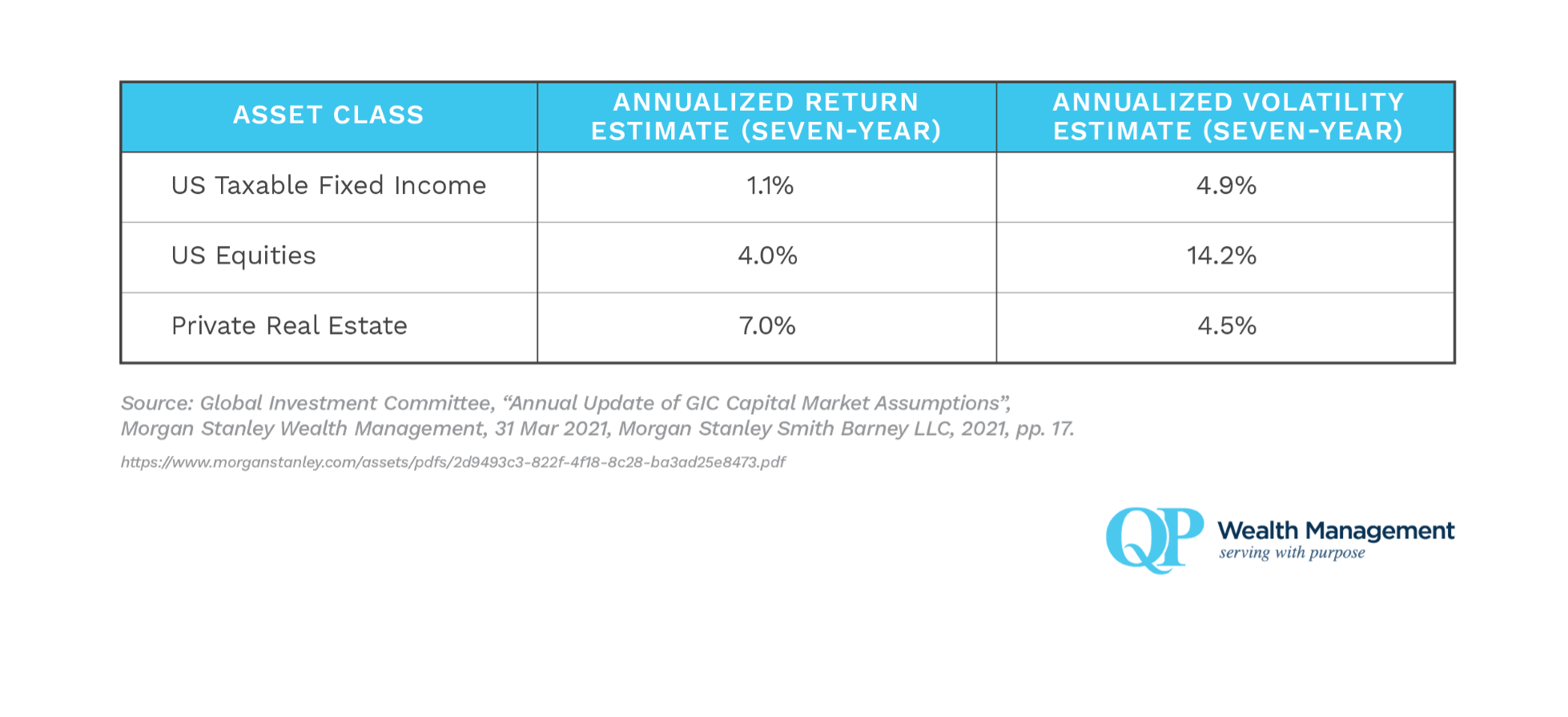

Most noteworthy, in Morgan Stanley’s Global Investment Committee seven-year outlook, private real estate has an estimated return of 7.0%. For reference, equities are forecasted to return 4.9% and US taxable fixed income to return 1.1%. Private real estate is estimated to return more than equities with less volatility than fixed income – let that sink in.

If you are considering private real estate, you need to be aware of investor requirements. Participation is typically limited to QP’s (qualified purchasers), QC’s (qualified clients), or accredited investors and investments usually require large commitments. The illiquidity associated with these investments is not suitable for all investors, regardless of their eligibility. For some, opportunistic private real estate is sought for the opportunity to capture high returns. Others may seek fixed income-like core with the intent of gaining lower volatility and stable income. Completely different risk profiles show up to invest in the same asset class with very different objectives. Ultimately, property type, tenant profile, location, and segment characteristics juridic what kind of investment. Lastly, manager selection is so important. Access to managers with knowledge, data, and resources is essential. Those with deep relationships and expertise in evaluating specific markets have a distinct advantage in portfolio development.

[1]source: Global Investment Committee, “Annual Update of GIC Capital Market Assumptions”, Morgan Stanley Wealth Management, 31 Mar 2021, Morgan Stanley Smith Barney LLC, 2021, pp. 17.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.

QP Wealth Management is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

QP Wealth Management may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.